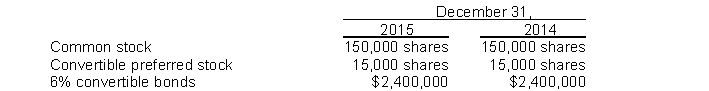

Use the following information for questions 124 and 125.

Information concerning the capital structure of Piper Corporation is as follows:  During 2015, Piper paid dividends of $0.60 per share on its common stock and $1.50 per share on its preferred stock. The preferred stock is convertible into 30,000 shares of common stock. The 6% convertible bonds are convertible into 75,000 shares of common stock. The net income for the year ended December 31, 2015, was $300,000. Assume that the income tax rate was 30%.

During 2015, Piper paid dividends of $0.60 per share on its common stock and $1.50 per share on its preferred stock. The preferred stock is convertible into 30,000 shares of common stock. The 6% convertible bonds are convertible into 75,000 shares of common stock. The net income for the year ended December 31, 2015, was $300,000. Assume that the income tax rate was 30%.

-What should be the diluted earnings per share for the year ended December 31, 2015, rounded to the nearest penny?

A) $1.74

B) $1.57

C) $1.33

D) $1.78

Correct Answer:

Verified

Q129: Warrants exercisable at $20 each to obtain

Q130: Foyle, Inc., had 680,000 shares of common

Q131: When computing diluted earnings per share, convertible

Q132: At December 31, 2014, Tatum Company had

Q133: Use the following information for questions 124

Q135: On January 1, 2015, Warren Corporation had

Q136: At December 31, 2014, Emley Company had

Q137: Prepare the necessary entries from 1/1/14-2/1/16 for

Q138: Terry Corporation had 480,000 shares of common

Q139: issued $4,000,000 of 12%, 5-year convertible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents