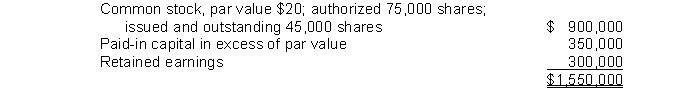

Presented below is the stockholders' equity section of Oaks Corporation at December 31, 2014:  During 2015, the following transactions occurred relating to stockholders' equity:3,000 shares were reacquired at $28 per share.3,000 shares were reacquired at $35 per share.1,800 shares of treasury stock were sold at $30 per share.For the year ended December 31, 2015, Oaks reported net income of $450,000. Assuming Oaks accounts for treasury stock under the cost method, what should it report as total stockholders' equity on its December 31, 2015, balance sheet?

During 2015, the following transactions occurred relating to stockholders' equity:3,000 shares were reacquired at $28 per share.3,000 shares were reacquired at $35 per share.1,800 shares of treasury stock were sold at $30 per share.For the year ended December 31, 2015, Oaks reported net income of $450,000. Assuming Oaks accounts for treasury stock under the cost method, what should it report as total stockholders' equity on its December 31, 2015, balance sheet?

A) $1,865,000.

B) $1,861,400.

C) $1,857,800.

D) $1,415,000.

Correct Answer:

Verified

Q84: Gibbs Corporation owned 20,000 shares of Oliver

Q85: Long Co. issued 100,000 shares of $10

Q86: An analysis of stockholders' equity of Hahn

Q87: On December 1, 2014, Abel Corporation exchanged

Q88: The stockholders' equity of Howell Company at

Q90: Luther Inc., has 4,000 shares of 6%,

Q91: Percy Corporation was organized on January 1,

Q92: Winger Corporation owned 600,000 shares of Fegan

Q93: On June 30, 2014, when Ermler Co.'s

Q94: Pierson Corporation owned 10,000 shares of Hunter

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents