Use the following information for questions 60 through 62:

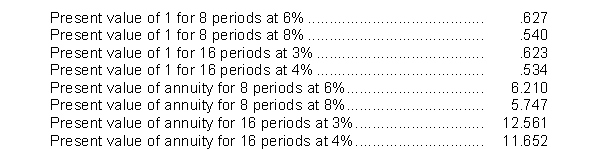

On January 1, 2014, Ellison Co. issued eight-year bonds with a face value of $4,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31. The bonds were sold to yield 8%. Table values are:

-The present value of the principal is

A) $2,136,000.

B) $2,160,000.

C) $2,492,000.

D) $2,508,000.

Correct Answer:

Verified

Q38: The rate of interest actually earned by

Q39: If bonds are issued initially at a

Q40: Treasury bonds should be shown on the

Q41: A troubled debt restructuring will generally result

Q42: Long-term debt that matures within one year

Q44: A corporation borrowed money from a bank

Q45: Which of the following arguments is presented

Q46: In a troubled debt restructuring in which

Q47: The times interest earned ratio is computed

Q48: The debt to assets ratio is computed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents