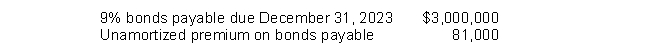

The December 31, 2014, balance sheet of Hess Corporation includes the following items:  The bonds were issued on December 31, 2013, at 103, with interest payable on July 1 and December 31 of each year. Hess uses straight-line amortization. On March 1, 2015, Hess retired $1,200,000 of these bonds at 98 plus accrued interest. What should Hess record as a gain on retirement of these bonds? Ignore taxes.

The bonds were issued on December 31, 2013, at 103, with interest payable on July 1 and December 31 of each year. Hess uses straight-line amortization. On March 1, 2015, Hess retired $1,200,000 of these bonds at 98 plus accrued interest. What should Hess record as a gain on retirement of these bonds? Ignore taxes.

A) $56,400.

B) $32,400.

C) $55,800.

D) $60,000.

Correct Answer:

Verified

Q92: Didde Company issues $20,000,000 face value of

Q93: Carr Corporation retires its $300,000 face value

Q94: A corporation called an outstanding bond obligation

Q95: On January 1, 2014, Crown Company sold

Q96: In the recent year Hill Corporation had

Q98: At December 31, 2014 the following balances

Q99: On January 1, 2014, Ann Price loaned

Q100: On January 1, Patterson Inc. issued $4,000,000,

Q101: Use the following information for questions *103

Q102: On July 1, 2013, Noble, Inc. issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents