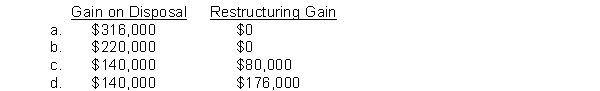

Eddy Co. is indebted to Cole under a $800,000, 12%, three-year note datedDecember 31, 2013. Because of Eddy's financial difficulties developing in 2015, Eddy owed accrued interest of $96,000 on the note at December 31, 2015. Under a troubled debt restructuring, on December 31, 2015, Cole agreed to settle the note and accrued interest for a tract of land having a fair value of $720,000. Eddy's acquisition cost of the land is $580,000. Ignoring income taxes, on its 2015 income statement Eddy should report as a result of the troubled debt restructuring

Correct Answer:

Verified

Q106: Prepare journal entries to record the following

Q107: A ten-year bond was issued in 2013

Q108: Use the following information for questions *103

Q109: On January 1, 2014, Huff Co. sold

Q110: In recent year Cey Corporation had net

Q112: Use the following information for questions *103

Q113: The adjusted trial balance for Lifesaver Corp.

Q114: On June 30, 2015, Omara Co. had

Q115: On January 1, 2010, Goll Corp. issued

Q116: Paige Co. took advantage of market conditions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents