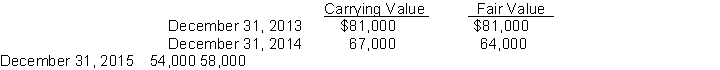

Harper Company commonly issues long-term notes payable to its various lenders. Harper has had a pretty good credit rating such that its effective borrowing rate is quite low (less than 8% on an annual basis). Harper has elected to use the fair value option for the long-term notes issued to Barclay's Bank and has the following data related to the carrying and fair value for these notes.

Instructions

(a) Prepare the journal entry at December 31 (Harper's year-end) for 2013, 2014, and 2015 to record the fair value option for these notes.

(b) At what amount will the note be reported on Harper's 2014 balance sheet?

(c) What is the effect of recording the fair value option on these notes on Harper's 2015 income?

Correct Answer:

Verified

Q124: IFRS requires bond issue costs:

A) to be

Q125: Accounting for a troubled debt settlement.Mann, Inc.,

Q126: IFRS requires the use of straight-line method

Q127: Prepare journal entries to record the following

Q128: Which of the following is not a

Q130: Under IFRS, bond issue costs are recorded

Q131: Both IFRS and U.S. GAAP permit valuation

Q132: IFRS generally assumes that all restructurings be

Q133: Bond discount amortization.On June 1, 2013, Everly

Q134: Ludwig, Inc., which owes Giffin Co. $1,600,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents