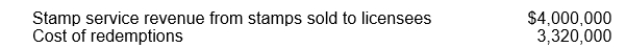

Core Trading Stamp Co. records stamp service revenue and provides for the cost of redemptions in the year stamps are sold to licensees. Core's past experience indicates that only 75% of the stamps sold to licensees will be redeemed. Core's liability for stamp redemptions was $5,000,000 at December 31, 2013. Additional information for 2014 is as follows:  If all the stamps sold in 2014 were presented for redemption in 2015, the redemption cost would be $3,000,000. What amount should Core report as a liability for stamp redemptions at December 31, 2014?

If all the stamps sold in 2014 were presented for redemption in 2015, the redemption cost would be $3,000,000. What amount should Core report as a liability for stamp redemptions at December 31, 2014?

A) $8,320,000.

B) $5,680,000.

C) $3,930,000.

D) $4,680,000.

Correct Answer:

Verified

Q136: On January 1, 2012, Bacon Co. leased

Q137: Crispy Frosted Flakes Company offers its customers

Q138: During 2013, Rao Co. introduced a new

Q139: Which of the following is generally associated

Q140: On January 3, 2014, Benton Corp. owned

Q142: On August 31, Latty Co. partially refunded

Q143: For purposes of recognizing a provision "probable"

Q144: Short-term debt obligations are classified as current

Q145: includes one coupon in each bag

Q146: Described below are certain transactions of Lamar

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents