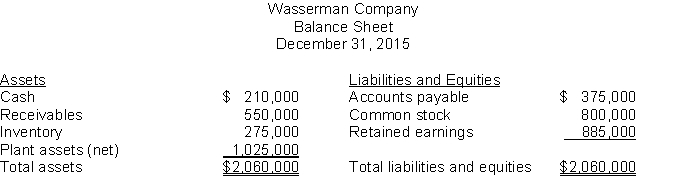

Vasquez Manufacturing Company decided to expand further by purchasing Wasserman Company. The balance sheet of Wasserman Company as of December 31, 2015 was as follows:  An appraisal, agreed to by the parties, indicated that the fair value of the inventory was $370,000 and that the fair value of the plant assets was $1,325,000. The fair value of the receivables is equal to the amount reported on the balance sheet. The agreed purchase price was $2,275,000, and this amount was paid in cash to the previous owners of Wasserman Company.

An appraisal, agreed to by the parties, indicated that the fair value of the inventory was $370,000 and that the fair value of the plant assets was $1,325,000. The fair value of the receivables is equal to the amount reported on the balance sheet. The agreed purchase price was $2,275,000, and this amount was paid in cash to the previous owners of Wasserman Company.

Instructions

Determine the amount of goodwill (if any) implied in the purchase price of $2,275,000. Show calculations.

Correct Answer:

Verified

Q143: IFRS allows reversal of impairment losses when

Q144: Listed below is a selection of accounts

Q145: The increased acceptance of IFRS has caused

Q146: Research and development activities may include

(a)

Q147: In early January 2013, Lerner Corporation applied

Q149: Costs in the research phase are expensed

Q150: Carrying value of patent.Sisco Co. purchased a

Q151: Recently, a group of university students decided

Q152: Costs in the research phase are always

Q153: IFRS differs from U.S. GAAP in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents