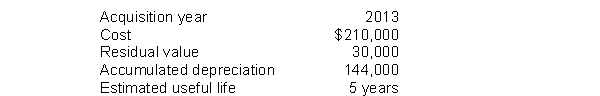

Harris Co. takes a full year's depreciation expense in the year of an asset's acquisition and no depreciation expense in the year of disposition. Data relating to one of Harris's depreciable assets at December 31, 2015 are as follows:  Using the same depreciation method as used in 2013, 2014, and 2015, how much depreciation expense should Harris record in 2016 for this asset?

Using the same depreciation method as used in 2013, 2014, and 2015, how much depreciation expense should Harris record in 2016 for this asset?

A) $24,000

B) $36,000

C) $42,000

D) $48,000

Correct Answer:

Verified

Q99: Morgan Corporation purchased a depreciable asset for

Q100: If Labor, Inc. uses the composite method

Q101: A machine with a five-year estimated useful

Q102: Barton Corporation acquires a coal mine at

Q103: In 2014, Bargain shop reported net income

Q105: Use the following information for questions 111

Q106: In 2006, Jarrett Company purchased a tract

Q107: On April 1, 2013, Verlin Co. purchased

Q108: Barton Corporation acquires a coal mine at

Q109: Porter Resources Company acquired a tract of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents