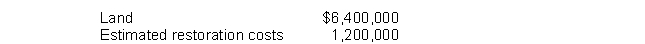

Galt Company acquired a tract of land containing an extractable natural resource. Galt is required by the purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the recoverable reserves will be 4,000,000 tons, and that the land will have a value of $600,000 after restoration. Relevant cost information follows:  If Galt maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

If Galt maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

A) $1.60

B) $1.75

C) $2.00

D) $1.90

Correct Answer:

Verified

Q125: Definitions.

Provide clear, concise answers for the following.

1.

Q126: Net income is understated if, in the

Q127: Calculate depreciation.

A machine cost $800,000 on April

Q128: Impairment.

Dolphin Company uses special strapping equipment in

Q129: True or False.

Place T or F in

Q131: Adjustment of Depreciable Base.A truck was acquired

Q132: Calculate depreciation.

A machine which cost $300,000

Q133: As with U.S. GAAP, IFRS requires that

Q134: A plant asset with a five-year estimated

Q135: In January 2014, Fritz Mining Corporation purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents