Depreciation methods.

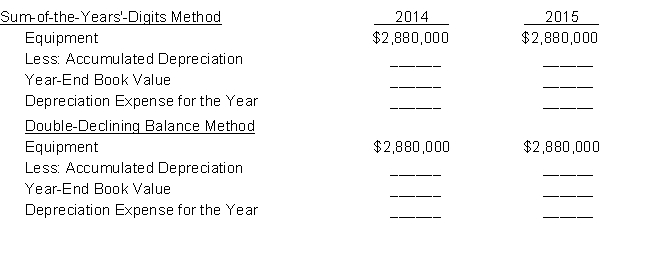

On July 1, 2014, Sport Company purchased for $2,880,000 snow-making equipment having an estimated useful life of 5 years with an estimated salvage value of $120,000. Depreciation is taken for the portion of the year the asset is used.

Instructions

(a) Complete the form below by determining the depreciation expense and year-end book values for 2014 and 2015 using the

1. sum-of-the-years'-digits method."

2. double-declining balance method.  (b) Assume the company had used straight-line depreciation during 2014 and 2015. During 2016, the company determined that the equipment would be useful to the company for only one more year beyond 2016. Salvage value is estimated at $160,000.(1) Compute the amount of depreciation expense for the 2016 income statement.(2) What is the depreciation base of this asset?"

(b) Assume the company had used straight-line depreciation during 2014 and 2015. During 2016, the company determined that the equipment would be useful to the company for only one more year beyond 2016. Salvage value is estimated at $160,000.(1) Compute the amount of depreciation expense for the 2016 income statement.(2) What is the depreciation base of this asset?"

Correct Answer:

Verified

Q116: Use the following information for questions 115

Q117: Use the following information for questions 115

Q118: In March, 2014, Mallory Mines Co. purchased

Q119: Norton, Inc. purchased equipment in 2013 at

Q120: During 2014, Corporation acquired a mineral mine

Q122: Under both IFRS and U.S. GAAP, interest

Q123: A depreciable asset has an estimated 15%

Q124: Asset depreciation and disposition.

Answer each of the

Q125: Definitions.

Provide clear, concise answers for the following.

1.

Q126: Net income is understated if, in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents