Use the following information for questions 78 through 80.

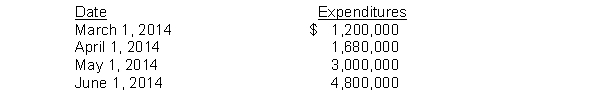

On March 1, 2014, Newton Company purchased land for an office site by paying $1,800,000 cash. Newton began construction on the office building on March 1. The following expenditures were incurred for construction:  The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $2,400,000 was borrowed on March 1, 2014 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2014 was a $1,000,000, 12%, 6-year note payable dated January 1, 2014.

The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $2,400,000 was borrowed on March 1, 2014 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2014 was a $1,000,000, 12%, 6-year note payable dated January 1, 2014.

-The weighted-average accumulated expenditures on the construction project during 2014 were

A) $1,280,000.

B) $9,780,000.

C) $1,040,000.

D) $2,320,000.

Correct Answer:

Verified

Q74: Use the following information for questions 63

Q75: Termination of an asset's service due to

Q76: Use the following information for questions 63

Q77: During self-construction of an asset by Richardson

Q78: On May 1, 2014, Goodman Company began

Q80: On March 1, Imhoff Co. began construction

Q81: Use the following information to answer questions

Q82: Use the following information to answer questions

Q83: Storm Corporation purchased a new machine on

Q84: Use the following information to answer questions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents