Use the following information for questions 78 through 80.

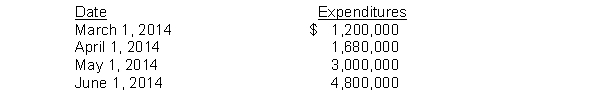

On March 1, 2014, Newton Company purchased land for an office site by paying $1,800,000 cash. Newton began construction on the office building on March 1. The following expenditures were incurred for construction:  The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $2,400,000 was borrowed on March 1, 2014 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2014 was a $1,000,000, 12%, 6-year note payable dated January 1, 2014.

The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $2,400,000 was borrowed on March 1, 2014 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2014 was a $1,000,000, 12%, 6-year note payable dated January 1, 2014.

-The actual interest cost incurred during 2014 was

A) $300,000.

B) $336,000.

C) $168,000.

D) $280,000.

Correct Answer:

Verified

Q56: Which of the following nonmonetary exchange transactions

Q57: When boot is involved in an exchange

Q58: Which of the following is not a

Q59: When a plant asset is acquired by

Q60: Which of the following is a capital

Q62: Which of the following statements about involuntary

Q63: Worthington Chandler Company purchased equipment for $36,000.

Q64: Gutierrez Company is constructing a building. Construction

Q65: Assume the weighted-average accumulated expenditures for the

Q66: Messersmith Company is constructing a building. Construction

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents