Capitalization of interest.

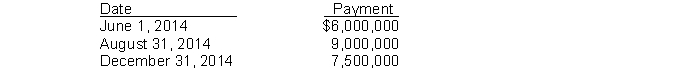

Early in 2014, Dobbs Corporation engaged Kiner, Inc. to design and construct a complete modernization of Dobbs's manufacturing facility. Construction was begun on June 1, 2014 and was completed on December 31, 2014. Dobbs made the following payments to Kiner, Inc. during 2014:  In order to help finance the construction, Dobbs issued the following during 2014:"

In order to help finance the construction, Dobbs issued the following during 2014:"

1. $5,000,000 of 10-year, 9% bonds payable, issued at par on May 31, 2014, with interest payable annually on May 31.

2. 1,000,000 shares of no-par common stock, issued at $10 per share on October 1, 2014.In addition to the 9% bonds payable, the only debt outstanding during 2014 was a $1,250,000, 12% note payable dated January 1, 2010 and due January 1, 2020, with interest payable annually on January 1.

Instructions

Compute the amounts of each of the following (show computations):"

1. Weighted-average accumulated expenditures qualifying for capitalization of interest cost.

2. Avoidable interest incurred during 2014.

3. Total amount of interest cost to be capitalized during 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q141: Nonmonetary exchange.

Rogers Co. had a sheet metal

Q142: Consider each of the items below. Place

Q143: Under IFRS, assets that qualify for interest

Q144: Consider each of the items below. Place

Q145: Under international accounting standards, historical cost is

Q147: Consider each of the items below. Place

Q148: Asset acquisition.

Ford Inc. plans to acquire an

Q149: Consider each of the items below. Place

Q150: Nonmonetary exchanges.Moore Corporation follows a policy of

Q151: Recently changes to IFRS require companies to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents