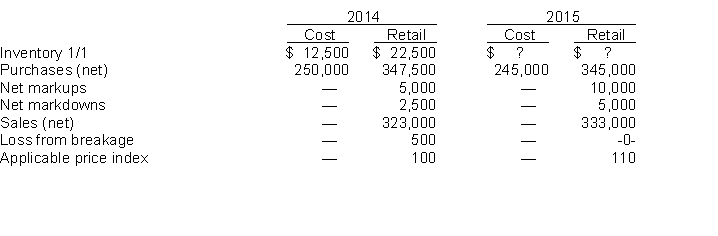

Retail LIFO.Klein Book Store uses the conventional retail method and is now considering converting to the LIFO retail method for the period beginning 1/1/15. Available information consists of the following:  Following is a schedule showing the computation of the cost of inventory on hand at 12/31/14 based on the conventional retail method.

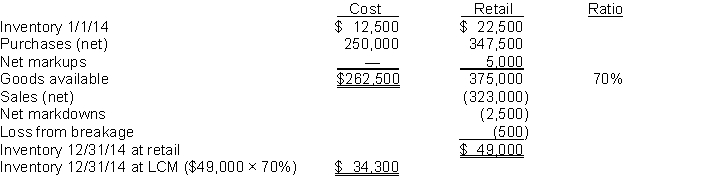

Following is a schedule showing the computation of the cost of inventory on hand at 12/31/14 based on the conventional retail method.

Instructions

(a) Prepare the journal entry to convert the inventory from the conventional retail to the LIFO retail method. Show detailed calculations to support your entry.

(b) Prepare a schedule showing the computation of the 12/31/15 inventory based on the LIFO retail method as adjusted for fluctuating prices. Without prejudice to your answer to

(a) above, assume that you computed the 1/1/15 inventory (retail value $49,000) under the LIFO retail method at a cost of $34,000.

Correct Answer:

Verified

Q146: Retail inventory method.

The records of Lohse Stores

Q147: Retail inventory method.

When you undertook the preparation

Q148: Gross profit method.

An inventory taken the morning

Q149: Similar to U.S. GAAP, certain agricultural products

Q150: IFRS uses a ceiling to determine market.

Q152: Gross profit method.

On January 1, a store

Q153: IFRS records market in the lower-of-cost-or-market differently

Q154: IFRS defines market as replacement cost subject

Q155: Dollar-value LIFO-retail method.

The records of Heese Stores

Q156: Where is the authoritative IFRS guidance related

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents