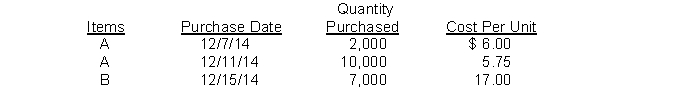

Wise Company adopted the dollar-value LIFO method on January 1, 2014, at which time its inventory consisted of 6,000 units of Item A @ $5.00 each and 3,000 units of Item B @ $16.00 each. The inventory at December 31, 2014 consisted of 12,000 units of Item A and 7,000 units of Item B. The most recent actual purchases related to these items were as follows:  Using the double-extension method, what is the price index for 2014 that should be computed by Wise Company?

Using the double-extension method, what is the price index for 2014 that should be computed by Wise Company?

A) 108.33%

B) 109.59%

C) 111.05%

D) 220.51%

Correct Answer:

Verified

Q132: How should the following costs affect a

Q133: Willy World began using dollar-value LIFO for

Q134: Walsh Retailers purchased merchandise with a list

Q135: Opera Corp. uses the dollar-value LIFO method

Q136: The following information applied to Howe, Inc.

Q138: Use the following information for 123 and

Q139: Use the following information for questions 125

Q140: Web World began using dollar-value LIFO for

Q141: FIFO and LIFO periodic inventory methods.

The Rock

Q142: Recording purchases at net amounts.

Dill Co. records

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents