Inventory methods.

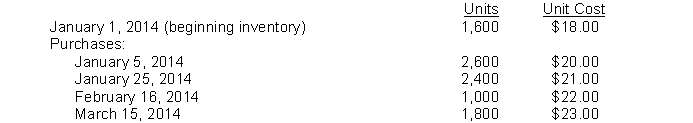

Jones Company was formed on December 1, 2013. The following information is available from Jones's inventory record for Product X.  A physical inventory on March 31, 2014, shows 2,000 units on hand.

A physical inventory on March 31, 2014, shows 2,000 units on hand.

Instructions

Prepare schedules to compute the ending inventory at March 31, 2014, under each of the following inventory methods:

(a) FIFO.

(b) LIFO.

(c) Weighted-average.Show supporting computations in good form.

Correct Answer:

Verified

Q146: Who owns the goods, as well as

Q147: Recording purchases at net amounts.

Flint Co. records

Q148: FIFO and LIFO inventory methods.During June, the

Q149: Hite Co. was formed on January 2,

Q150: Dollar-value LIFO.

Aber Company manufactures one product. On

Q152: U.S. GAAP has less detailed rules related

Q153: Dollar-value LIFO method.

Part A. Judd Company has

Q154: Comparison of FIFO and LIFO.

During periods of

Q155: Accounting for purchase discounts.

Otto Corp. purchased merchandise

Q156: When the double-extension approach to the dollar-value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents