Use the following information to answer questions 6-8.

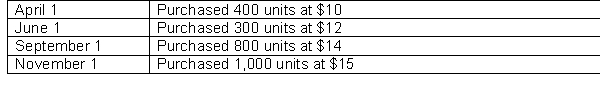

Barton Company uses a periodic inventory system. On January 1, 2014, Barton Company had 1,200 units of inventory on hand at a cost of $8 per unit. During 2014, Barton made the following inventory purchases.  Assume Barton Company sold 2,300 units of inventory during 2014.

Assume Barton Company sold 2,300 units of inventory during 2014.

-If you assume that Barton follows IFRS and uses the FIFO method, what is the ending inventory and cost of goods sold, respectively?

A) Ending inventory = $11,600; Cost of Goods Sold = $31,800

B) Ending inventory = $16,520; Cost of Goods Sold = $26,880

C) Ending inventory = $16,422; Cost of Goods Sold = $26,978

D) Ending inventory = $20,600; Cost of Goods Sold = $22,800

Correct Answer:

Verified

Q162: Both U.S. GAAP and IFRS permit the

Q163: Both U.S. GAAP and IFRS exclude which

Q164: Which of the following is an advantage

Q165: Which of the following best describes the

Q166: IFRS does not permit the LIFO method

Q168: Use the following information to answer questions

Q169: Many U.S. companies that have international operations

Q170: Under IFRS, an entity should initially recognize

Q171: Based on your answers to Questions 6

Q172: Under IFRS, inventories are classified as

A) noncurrent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents