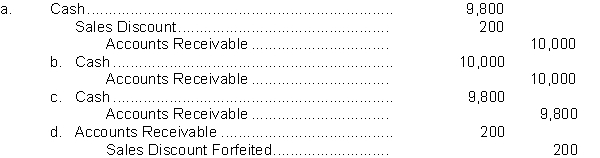

On July 22, Peter sold $15,500 of inventory items on credit with the terms 2/15, net 30. Payment on $10,000 sales was received on August 1 and the remaining payment was received on August 12. Assuming Peter uses the gross method of accounting for sales discounts, which one of the following entries was made on August 1 to record the cash received?

Correct Answer:

Verified

Q78: 71. The accounts receivable turnover ratio

Q79: Antique Company has notes receivable that have

Q80: When should a transfer of receivables be

Q81: Lawrence Company has cash in bank of

Q82: Jenny Manufactures sold toys listed at $240

Q84: On January 1, 2014, Lynn Company borrows

Q85: Kennison Company has cash in bank of

Q86: Consider the following: Cash in Bank -

Q87: Wellington Corp. has outstanding accounts receivable totaling

Q88: At the close of its first year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents