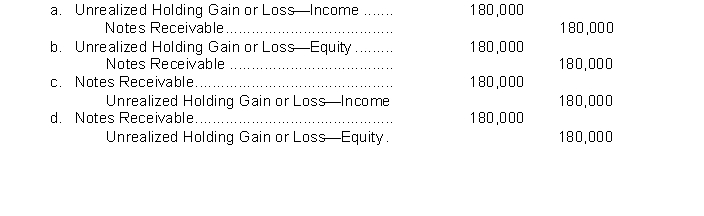

Jones Company has notes receivable that have a fair value of $570,000 and a carrying amount of $750,000. Jones decides on December 31, 2014, to use the fair value option for these recently-acquired receivables. Which of the following entries will be made on December 31, 2014 to record the unrealized holding gain/loss?

Correct Answer:

Verified

Q100: AG Inc. made a $15,000 sale on

Q101: Lester Company received a seven-year zero-interest-bearing note

Q102: On December 31, 2014, Flint Corporation sold

Q103: McGlone Corporation had a 1/1/14 balance in

Q104: Use the following information for questions 104

Q106: Equestrain Roads accepted a customer's $50,000 zero-interest-bearing

Q107: Lankton Company has the following account balances

Q108: During the year, Kiner Company made an

Q109: Vasguez Corporation had a 1/1/14 balance in

Q110: Assuming the market interest rate is 10%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents