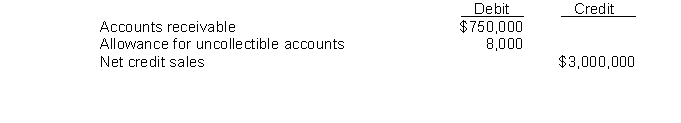

The following accounts were abstracted from Starr Co.'s unadjusted trial balance at December 31, 2014:  Starr estimates that 4% of the gross accounts receivable will become uncollectible. After adjustment at December 31, 2014, the allowance for uncollectible accounts should have a credit balance of

Starr estimates that 4% of the gross accounts receivable will become uncollectible. After adjustment at December 31, 2014, the allowance for uncollectible accounts should have a credit balance of

A) $120,000.

B) $112,000.

C) $38,000.

D) $30,000.

Correct Answer:

Verified

Q155: Entries for bad debt expense.

A trial balance

Q156: On January 1, 2014, West Co. exchanged

Q157: Under the allowance method of recognizing uncollectible

Q158: Nenn Co.'s allowance for uncollectible accounts was

Q159: Accounts receivable assigned.

Accounts receivable in the amount

Q161: The IFRS approach for derecognizing a receivable

Q162: IFRS requires an impairment loss for a

Q163: Both the FASB and IASB have indicated

Q164: Under IFRS, the characteristics that would imply

Q165: Under IFRS, there is no specific standard

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents