Amortization of discount on note.

On December 31, 2014, Green Company finished consultation services and accepted in exchange a promissory note with a face value of $600,000, a due date of December 31, 2017, and a stated rate of 5%, with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of 10%.

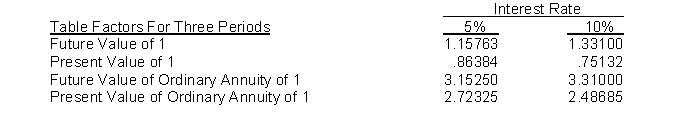

The following interest factors are provided:

Instructions

(a) Determine the present value of the note.

(b) Prepare a Schedule of Note Discount Amortization for Green Company under the effective interest method. (Round to whole dollars.)

(c) Explain how the accounting for a zero-interest-bearing note would differ in

(a) and (b) above.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q139: On February 1, 2014, Henson Company factored

Q140: Remington Corporation had accounts receivable of $100,000

Q141: In preparing its August 31, 2014 bank

Q142: IFRS and U.S. IFRS are very similar

Q143: On the December 31, 2014 balance sheet

Q145: Entries for bad debt expense.

The trial balance

Q146: On June 1, 2014, Yang Corp. loaned

Q147: For the year ended December 31, 2014,

Q148: Allowance for doubtful accounts.

When a company has

Q149: Tresh, Inc. had the following bank reconciliation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents