Use the Following Information for Questions 98 Through 100 Included in Accounts Receivable Is $1,200,000 Due from a Customer

Use the following information for questions 98 through 100.

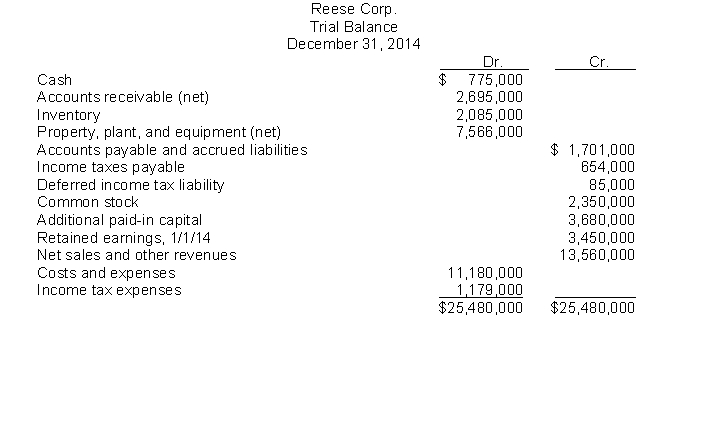

The following trial balance of Reese Corp. at December 31, 2014 has been properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014:

Other financial data for the year ended December 31, 2014:

Included in accounts receivable is $1,200,000 due from a customer and payable in quarterly installments of $150,000. The last payment is due December 29, 2016.

The balance in the Deferred Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $20,000 is classified as a current liability.

During the year, estimated tax payments of $525,000 were charged to income tax expense. The current and future tax rate on all types of income is 30%.

In Reese's December 31, 2014 balance sheet,

-The current assets total is

A) $6,080,000.

B) $5,555,000.

C) $5,405,000.

D) $4,955,000.

Correct Answer:

Verified

Q76: Which of the following best exemplifies a

Q77: _ ratios measure how effectively a company

Q78: The current cash debt coverage is often

Q79: Which of the following balance sheet classifications

Q80: One of the benefits of the statement

Q82: Packard Corporation reports the following information:

Q83: During 2014 the DLD Company had a

Q84: Use the following information for questions

Q85: Lohmeyer Corporation reports: Q86: Presented below are data for Antwerp Corp.![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents