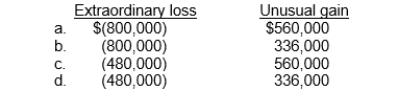

Prophet Corporation has an extraordinary loss of $800,000, an unusual gain of $560,000, and a tax rate of 40%. At what amount should Prophet report each item?

Correct Answer:

Verified

Q92: At Ruth Company, events and transactions during

Q93: Sandstrom Corporation has an extraordinary loss of

Q94: A review of the December 31, 2014,

Q95: Palomo Corp has a tax rate of

Q96: Norling Corporation reports the following information:

Q98: At Ruth Company, events and transactions during

Q99: Madsen Company reported the following information for

Q100: Arreaga Corp. has a tax rate of

Q101: Income statement disclosures.What is disclosed in an

Q102: Perry Corp. reports operating expenses in two

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents