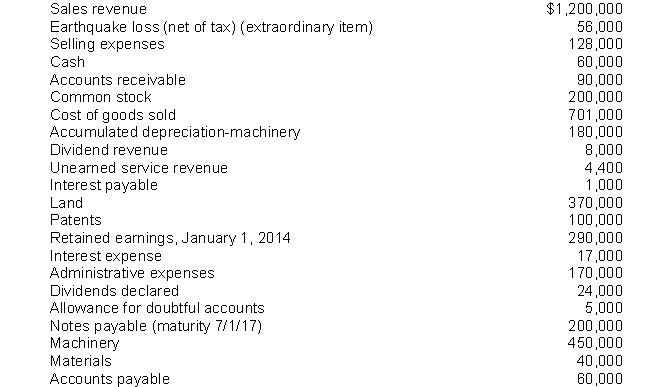

Income statement and retained earnings statement.Porter Corporation's capital structure consists of 50,000 shares of common stock. At December 31, 2014 an analysis of the accounts and discussions with company officials revealed the following information:  The amount of income taxes applicable to ordinary income was $57,600, excluding the tax effect of the earthquake loss which amounted to $24,000.

The amount of income taxes applicable to ordinary income was $57,600, excluding the tax effect of the earthquake loss which amounted to $24,000.

Instructions

(a) Prepare a multiple-step income statement.

(b) Prepare a retained earnings statement.

Correct Answer:

Verified

Q121: Listed below in scrambled order are 13

Q122: Which of the following is true of

Q123: Under IFRS, a company may classify expenses

Q124: Classification of income statement and retained earnings

Q125: Both U.S. GAAP and IFRS discuss income

Q127: Income statement form.Wilcox Corporation had income from

Q128: Both IFRS and U.S. GAAP allow for

Q129: If a company prepares a consolidated income

Q130: Multiple-step income statement.Presented below is information related

Q131: Boston Company owns more than 50 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents