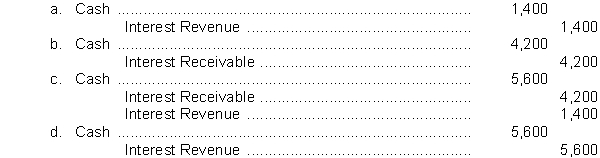

A company receives interest on a $70,000, 8%, 5-year note receivable each April 1. At December 31, 2014, the following adjusting entry was made to accrue interest receivable:

Interest Receivable 4,200

Interest Revenue 4,200

Assuming that the company does not use reversing entries, what entry should be made on April 1, 2015 when the annual interest payment is received?

Correct Answer:

Verified

Q88: Maso Company recorded journal entries for the

Q89: A reversing entry should never be made

Q90: The income statement of Dolan Corporation for

Q91: Big-Mouth Frog Corporation had revenues of $300,000,

Q92: The worksheet for Sharko Co. consisted of

Q94: Brown Company's account balances at December 31,

Q95: Panda Corporation paid cash of $60,000 on

Q96: Adjusting entries that should be reversed include

Q97: Adjusting entries that should be reversed include

A)

Q98: A company receives interest on a $70,000,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents