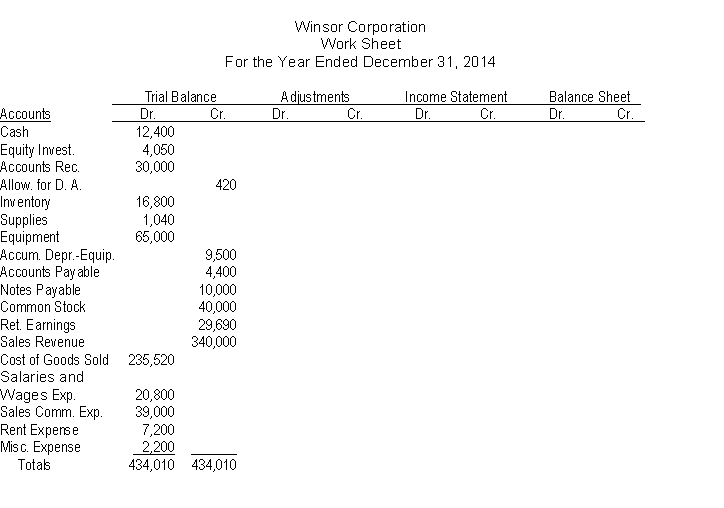

Eight-column work sheet.The trial balance of Winsor Corporation is reproduced on the following page. The information below is relevant to the preparation of adjusting entries needed to both properly match revenues and expenses for the period and reflect the proper balances in the real and nominal accounts.

InstructionsAs the accountant for Winsor Corporation, you are to prepare adjusting entries based on the following data, entering the adjustments on the work sheet and completing the additional columns with respect to the income statement and balance sheet. Carefully key your adjustments and label all items. (Due to time constraints, an adjusted trial balance is not required.) Round all computations to the nearest dollar.

(a) Winsor determined that one percent of sales will become uncollectible.

(b) Depreciation is computed using the straight-line method, with an eight-year life and $1,000 salvage value.

(c) Salesmen are paid commissions of 15% of sales. Commissions on sales for December have not been paid.(d) The note was issued on October 1, bearing interest at 8%, due Feb. 1, 2015.(e) A physical inventory of supplies indicated $340 of supplies currently in stock.(f) Provisions of a lease contract specify payments must be made one month in advance, with monthly payments at $800/mo. This provision has been complied with as of Dec. 31, 2014.

Correct Answer:

Verified

Q128: Accrual basis.The records for Kiley Company showed

Q129: Cash basis vs. accrual basis of accounting.Contrast

Q130: IASB is working to establish high-quality auditing

Q131: Adjusting entries.Reed Co. wishes to enter receipts

Q132: Terminology.In the space provided at the right,

Q134: The following information is available for Ace

Q135: Definitions.Provide clear, concise answers for the following.

1.

Q136: Icon International, a software company, incorporated on

Q137: Accrual basis.Grier & Associates maintains its records

Q138: Accrual basis.Sales salaries paid during 2014 were

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents