Notes Receivable.On December 31, 2013 Berry Corporation sold some of its product to Flynn Company, accepting a 3%, four-year promissory note having a maturity value of $800,000 (interest payable annually on December 31). Berry Corporation pays 6% for its borrowed funds. Flynn Company, however, pays 8% for its borrowed funds. The product sold is carried on the books of Berry at a manufactured cost of $495,000. Assume Berry uses a perpetual inventory system.

Instructions

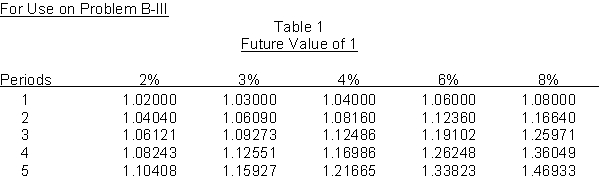

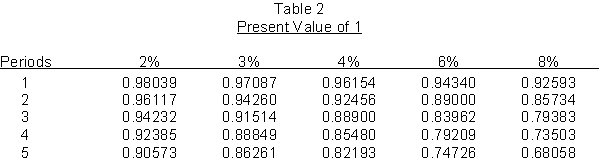

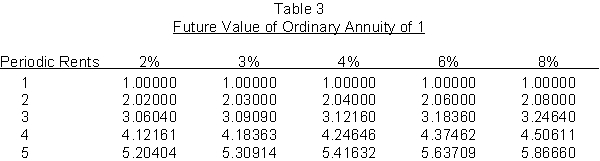

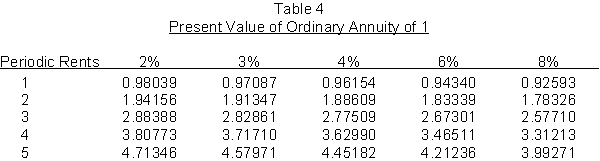

(a) Prepare the journal entries to record the transaction on the books of Berry Corporation at December 31, 2013. (Assume that the effective interest method is used. Use the interest tables below and round to the nearest dollar.)(b) Make all appropriate entries for 2014 on the books of Berry Corporation.

(c) Make all appropriate entries for 2015 on the books of Berry Corporation.

Correct Answer:

Verified

Q28: Why are inventories included in the computation

Q70: Certain information relative to the 2014

Q71: Wade Company estimates the cost of

Q72: FIFO vs. LIFO.In comparing and contrasting FIFO

Q73: When should the loss on an uncollectible

Q74: Year-end Inventory Cutoff.Abel Company's business year ends

Q77: How should unearned discounts, finance charges, and

Q78: Kramer Company values its inventory by using

Q79: Conventional and LIFO Retail Method.Note to Instructor.

Q80: How does failure to record accrued revenue

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents