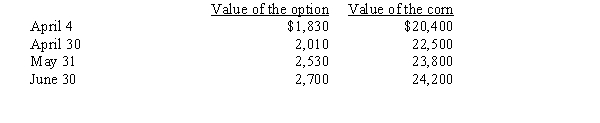

On April 4, Alam Company purchased a call option on 10,000 bushels of corn with delivery on June 30. The strike price is $2.15 per bushel. The value of the option and the market value of the corn are as follows.

A) On April 4, the intrinsic value of the option is $1,100.

B) On April 30, the time value of the option is $1,010.

C) On May 31, the intrinsic value of the option is $230.

D) On June 30, the time value of the option is $2,700.

Correct Answer:

Verified

Q2: A critical characteristic of a derivative is

Q3: Jenson Company buys 20 contracts on the

Q5: Clark Company holds several options:

Q5: The underlying amount of a derivative instrument

Q7: The total value of a derivative is

Q10: On September 1st of the current year,

Q12: A forward contract

A)is not traded on an

Q21: Which of the following is true about

Q29: Based on the relationship between the strike

Q31: The difference between the strike price of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents