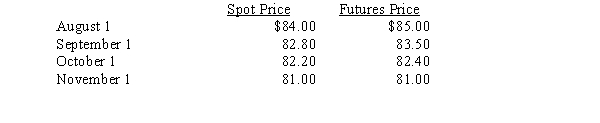

On August 1, an oil producer decided to hedge the fair value of its inventory by acquiring a futures contract to sell 100,000 barrels of oil on November 1 for $85.00 each. Price data follow:  What is the current period change in time value that would be recognized in earnings as of October 1?

What is the current period change in time value that would be recognized in earnings as of October 1?

A) $260,000

B) $110,000

C) $50,000

D) $60,000

Correct Answer:

Verified

Q25: An advantage of a fair value hedge

Q28: On February 1, Durham Company writes a

Q32: On September 23, Gensil Company buys 40

Q35: On January 1, 20X3, Shuey Company borrowed

Q36: During the second quarter of 20X5, Bertke

Q38: Interest rate swaps

A)are a type of Futures

Q38: On January 1, 20X3, Shuey Company borrowed

Q40: A swap

A)is not traded on an organized

Q41: At the beginning of 20X5, a derivative

Q54: Under special accounting treatment for cash flow

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents