Wayne Corporation, a manufacturer of farm machinery, had poor financial results last year because of a drought. Back orders indicate complete recovery this year. To eliminate a deficit that increased when the books were closed at the end of last year, the corporation has received stockholders' and state approval to conduct a quasi-reorganization on January 2.

Required:

Prepare journal entries as of January 2 to record the quasi-reorganization and the stockholders' equity section of its balance sheet immediately thereafter. The following data are pertinent:

a.Inventory at year-end is shown at FIFO cost of $280,000. Inventory is to be valued at replacement cost of $250,000.

b.Property, plant, and equipment are shown in the records at $4,000,000, net of accumulated depreciation. They are to be written down to fair value of $3,100,000.

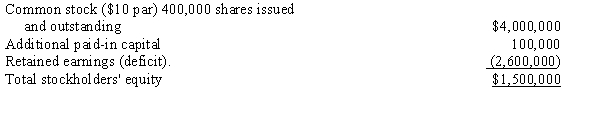

c.Stockholders' equity consists of:  Par value of stock is to be reduced from $10 to $1 per share. Paid-in capital related to the former stock is to be canceled.

Par value of stock is to be reduced from $10 to $1 per share. Paid-in capital related to the former stock is to be canceled.

d.The deficit is to be eliminated.

Correct Answer:

Verified

Q25: On June 1, 20X5, the books of

Q26: Mallory Corporation is being liquidated under Chapter

Q29: A corporation's accounting statement of affairs shows

Q31: Lakeside Bank holds a $100,000 note secured

Q32: In the accounting statement of affairs, the

Q33: Following is the balance sheet of Tontoe

Q34: The document used by a trustee to

Q35: The Statement of Realization and Liquidation differs

Q39: Hogan, Inc.is a telecommunications company.Currently, Hogan is

Q49: Describe the options that are available to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents