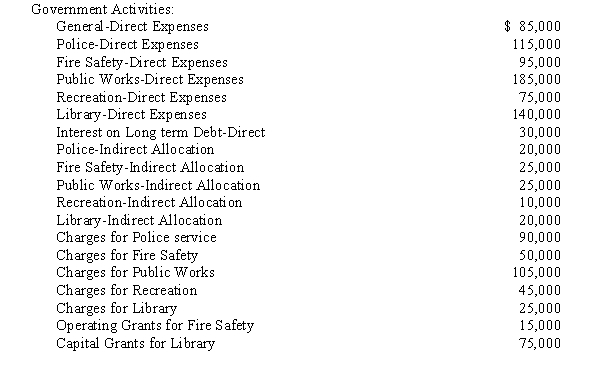

The City of Terrytown reports the following information:

There are no business type activities for this city or other component units. Taxes raised for general revenues equal $200,000 and taxes raised for debt service equal $25,000. Other general revenues were generated through fines, fees, and permits that total $100,000. The city also sold a plot of land for a gain of $10,000. The beginning of the year net assets totaled $155,000.

Required:

Prepare a statement of activities schedule for the city.

Correct Answer:

Verified

Q7: Which of the following were innovations in

Q19: Which of the following combination of items

Q21: The Single Audit Act requires that a

Q22: GASB Statement No.34 requires a separate set

Q23: From the following information, prepare a statement

Q26: Governmental entities are required to present fund

Q28: Audit reports prepared under the Single Audit

Q31: Briefly discuss the minimum requirements of the

Q34: Which of the following is not a

Q37: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents