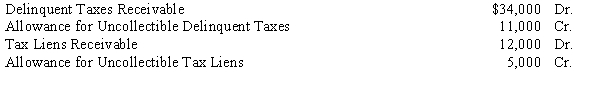

The following selected account balances for the City of Hampton on January 1, 20X8 are listed below:

Required:

Record the following transactions that occurred during 20X8:

a.Current property taxes are levied at $750,000 with a 4% allowance for uncollectible property taxes.

b.Property to which tax liens apply is sold for $6,000 and the account is closed.

c.Current property taxes are collected in the amount of $702,000.

d.Previous delinquent property taxes are converted to tax liens and the current uncollected property taxes are considered delinquent.

Correct Answer:

Verified

Q64: Explain why governmental funds use budgetary accounts.

Q65: Following is a list of selected transactions

Q66: Describe the three basic fund types and

Q67: The following activities took place in the

Q68: The following transactions were made by Cape

Q69: The following transactions were made by the

Q70: Consider the following events:

a.The General Fund vouchered

Q71: Following is a list of selected transactions

Q73: What is the concept of interperiod equity?

Q74: Lake City had the following transactions.

July 1,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents