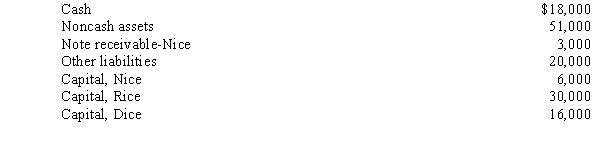

The Nice, Rice, and Dice Partnership has not been successful. The partners have determined they must liquidate their partnership. The partners have agreed to liquidate the partnership and anticipate that liquidation expenses will total $1,000. Prior to the liquidation, the partnership balance sheet reflects the following book values:

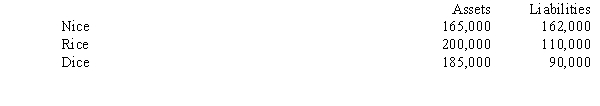

Profits and losses are shared 45% to Nice, 35% to Rice, and 20% to Dice. A review of the individual partner's personal net worth reveals the following:

The following transactions occur:

a.Assets having a book value of $40,000 are sold for $22,000 cash

b.Liabilities are paid, where possible

c.Partners contribute from their personal net worth, according to RUPA requirementsRequired:Prepare liquidation schedule and determine how the available assets will be distributed using a schedule of safe payments.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: The right of offset doctrine

A)sets aside the

Q38: Which of the following statements is correct

Q39: Assume that a partnership had assets with

Q40: Palit buys Quincy's partnership interest in the

Q41: The ALPHA, BETA, AND DELTA partnership has

Q43: Rogers, Davis, and Smukalla have capital balances

Q44: On July 1, 20X9, the Crawford Company

Q45: The partnership of Able, Bower, and Cramer

Q46: Luc, Denis, and Rollande have capital balances

Q47: Oak, Pine, and Maple are partners with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents