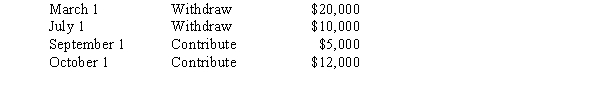

The Amato, Bergin, Chelsey partnership profit allocation agreement calls for salaries of $15,000 and $30,000 for Amato & Bergin, respectively. Amato is also to receive a bonus equal to 10% of partnership income after her bonus. Interest at the rate of 10% is to be allocated to Chelsey based on his weighted average capital after draws. Any remaining profit (or loss) is to be allocated equally among the partners. Chelsey began the current year with a capital balance of $54,000 and had the following subsequent activity:

Required:

Assuming the partnership has income of $66,000, determine the amounts to be allocated to each partner.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: A partnership where all partners may participate

Q20: When partnership profits are allocated based on

Q21: Maxwell is trying to decide whether to

Q22: Tupper and Tolin have decided to form

Q25: Partners Tuba and Drum share profits and

Q26: Ace & Barnes partnership has income of

Q27: Partners A and B have a profit

Q28: Partners A and B have a profit

Q29: Partners A and B have a profit

Q29: Partners A and B have a profit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents