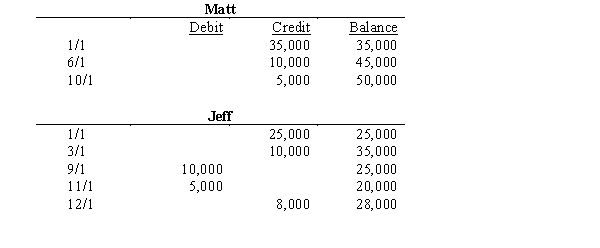

Matt and Jeff organized their partnership on 1/1/00. The following entries were made into their capital accounts during 00:

If partnership profits for the year equaled $66,000, indicate the allocations between the partners under the following independent profit-sharing allocation conditions:

a.Interest of 10% is allocated on weighted average capital balance and the remainder is divided equally

b.A salary of $9,000 will be allocated to Jeff; 10% interest on ending capital is allocated to the partners; remainder is divided 60/40 to Matt and Jeff, respectively

c.Salaries are allocated to Matt and Jeff in the amount of $10,000 and $15,000, respectively and the remainder is allocated in proportion to weighted average capital balances

d.A bonus of 10% of partnership profits after bonus is credited to Matt, a salary of $35,000 is allocated to Jeff, a $20,000 salary is allocated to Matt, 10% interest on weighted capital is allocated, and remainder is split equally

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Maxwell is trying to decide whether to

Q32: Maxwell is a partner and has an

Q33: Partners Acker, Becker & Checker have the

Q34: Which of the following would be least

Q35: Which of the following statements is true

Q37: Partners active in a partnership business should

Q38: Carey and Drew formed a partnership on

Q39: Olsen and Katch organized the OK Partnership

Q40: Partners Tuba and Drum share profits and

Q41: There are several differences between a partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents