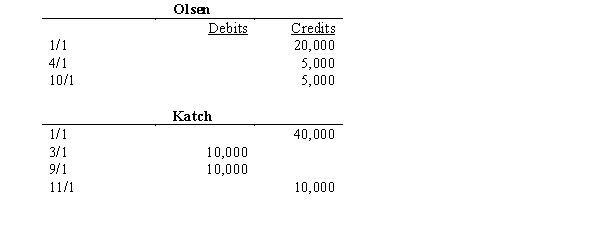

Olsen and Katch organized the OK Partnership on 1/1/01. The following entries were made into their capital accounts during 01:

The partnership agreement called for the following in the allocation of partnership profits and losses:

Salaries of $48,000 and $36,000 would be allocated to Olsen and Katch, respectively

Interest of 8% on average capital balances will be allocated

Katch will receive a bonus of 10% on all partnership billings in excess of $300,000

Any remaining profits/losses will be allocated 60/40 to Olsen and Katch, respectively.

Required (account for each situation independently):

a.Determine the distribution of partnership net income. Assume the following priority of allocation: interest, bonus, salaries, then remaining assuming partnership income of $85,000; partnership billings amounted to $400,000

b.Determine the distribution of partnership net income of $165,000 on billings of $400,000. No specific priority is given to any of the allocation criteria.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Which of the following would be least

Q35: Which of the following statements is true

Q36: Matt and Jeff organized their partnership on

Q37: Partners active in a partnership business should

Q38: Carey and Drew formed a partnership on

Q40: Partners Tuba and Drum share profits and

Q41: There are several differences between a partnership

Q42: Turner, Ike, and Gibson formed a partnership

Q43: Barnes and Noble, both lawyers, have decided

Q44: Cable and Jones are considering forming a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents