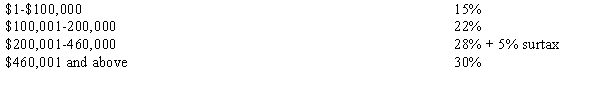

Lancaster Inc. expects to have taxable income of $275,000 for 20X1 and a tax credit of $12,250. Assume that the graduated tax rate schedule is as follows:

Required:

Determine the tax expense for the first quarter, assuming that taxable income is $65,000.

Correct Answer:

Verified

Q23: Which of the following is not considered

Q24: In determining if two operating segments may

Q29: A reconciliation of the revenue, profit and

Q30: With regard to major customers, which of

Q34: The acquisition of a paper mill by

Q36: Ansfield, Inc. has several potentially reportable segments.

Q40: In determining whether a segment should be

Q41: Egan Company, a publicly-traded company, divides its

Q50: The following lists account titles found on

Q56: The following events took place in Morgan

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents