Millstone Company's first-quarter 20X3, pretax income is $25,000. The company anticipates an annual tax credit of $5,500. Millstone is projecting income for the remaining three quarters of $95,000. For the second quarter of 20X4, Millstone reports $55,000 of pretax income with a projected pre-tax income for the remainder of the year of $65,000. Millstone does not have any permanent differences between taxable income and financial income.

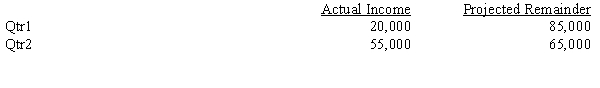

In the second quarter, Millstone decided to change their depreciation method used for financial reporting purposes. The change in depreciation methods has the following effect on the calculation and projection of income for Millstone:

The effect of the change on prior years is a decrease to retained earnings of $30,000.

The current tax schedule is:

Required:

Calculate the first and second quarter interim tax expenses on continuing income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Adam Enterprise includes seven industry segments. Operating

Q46: Corriveau Industries decided to switch from an

Q49: Consider the following:

Case A

Income (loss) for quarters

Q50: The following lists account titles found on

Q51: Information about the seven segments of the

Q55: Discuss the criteria emphasized in the "management

Q60: Explain the difference in the independent and

Q61: Stidham Company is a large international company

Q62: In addition to disclosures about reportable segments,

Q63: For purposes of interim reporting, US-GAAP permits

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents