In January, 20X3, Dudwil Corporation acquired a foreign subsidiary, Holman Company, by paying cash for all of the outstanding common stock of Holman. On the purchase date, Holman Company's accounts were stated fairly in local currency units (FC). Subsequent sales of Holman's common stock have been purchased by Dudwil to maintain its 100% ownership.

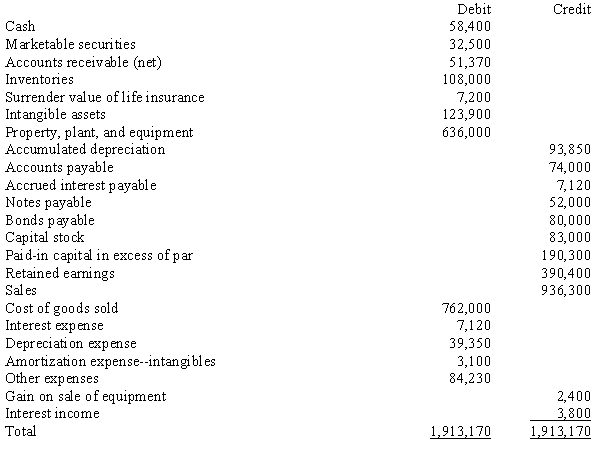

Holman's trial balance, in functional currency units (same as the local currency units), on December 31, 20X7, follows:

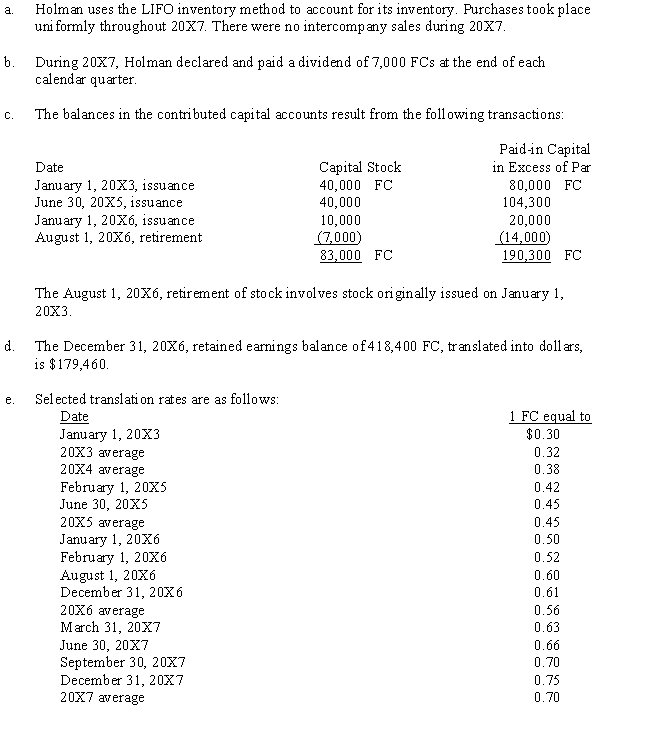

The following additional information is available:

Required:

Prepare a schedule to translate the December 31, 20X7, trial balance of Holman Company from local currency units to dollars. The schedule should show the trial balance in FCs, the exchange rates, and the trial balance. (Do not extend the trial balance to statement columns. Supporting schedules should be in good form.)

Correct Answer:

Verified

Q40: If the functional currency is determined to

Q41: On January 1, 20X1, Rapid Corporation purchased

Q42: A foreign subsidiary of Dallas Jeans Corp.

Q43: Which of the following procedures would be

Q44: Which of the following best describes the

Q45: In most cases, which of the following

Q46: Patents are on the books of a

Q47: A U.S. firm purchased 100% of a

Q49: Green Corporation, a wholly owned British subsidiary

Q50: The adjustment resulting from the remeasurement of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents