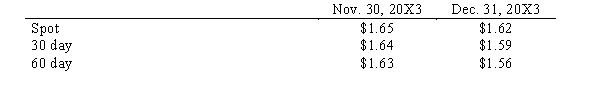

Hugh, Inc. purchased merchandise for 300,000 FC from a British vendor on November 30, 20X3. Payment in British pounds is due January 31, 20X4. Exchange rates to purchase 1 FC is as follows:  In the December 31, 20X3 income statement, what amount should Hugh report as foreign exchange gain from this transaction?

In the December 31, 20X3 income statement, what amount should Hugh report as foreign exchange gain from this transaction?

A) $3,000 loss

B) $9,000 gain

C) $9,000 loss

D) $3,000 gain

Correct Answer:

Verified

Q2: When an economic transaction is denominated in

Q5: A forward exchange contract is being transacted

Q10: Which of the following factors influences the

Q13: Wild, Inc. sold merchandise for 500,000 FC

Q14: Foreign currency transactions not involving a hedge

Q19: A U.S.manufacturer has sold computer services to

Q20: A U.S. manufacturer has sold goods to

Q23: On 6/1/X2, an American firm purchased inventory

Q31: Which of the following statements is not

Q34: The purpose of a hedge on an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents