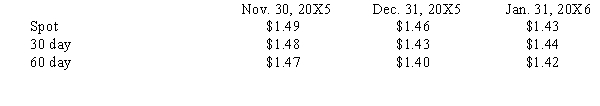

Larson, Inc. sold merchandise for 600,000 FC to a foreign vendor on November 30, 20X5. Payment in foreign currency is due January 31, 20X6. On the same day, Larson signed an agreement with a foreign exchange broker to sell 600,000 FC on January 31, 20X6. Exchange rates to purchase 1 FC are as follows:  What will be the recorded amount of the Forward Contract on November 30, 20X5?

What will be the recorded amount of the Forward Contract on November 30, 20X5?

A) $894,000

B) $888,000

C) $882,000

D) $0

Correct Answer:

Verified

Q5: A forward exchange contract is being transacted

Q20: A U.S. manufacturer has sold goods to

Q23: On 6/1/X2, an American firm purchased inventory

Q25: Larson, Inc. sold merchandise for 600,000 FC

Q27: A derivative:

A)requires little or no initial investment.

B)derives

Q27: Pile, Inc. purchased merchandise for 500,000 FC

Q28: On 6/1/X2, an American firm purchased inventory

Q28: Gains and losses resulting from a derivative

Q31: Which of the following statements is not

Q34: The purpose of a hedge on an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents