Remle Corporation is a U.S. corporation that sold merchandise a foreign manufacturer on March 1, 20X9 for 200,000 foreign currency units. The funds will be received on April 30, 20X9. On March 1, 20X9 Wolters also entered into a forward contract to sell 200,000 foreign currency units on April 30, 20X9. Remle has a March 31 year end.

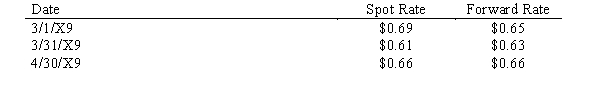

Exchange rates are as follows:

Required:

Prepare the journal entries to record the transactions through April 30, 20X9. March 31 is the fiscal period end. Ignore the split between spot gain/loss and time value and Cost of Goods Sold.

Correct Answer:

Verified

Q21: Exchange gains and losses on a forward

Q38: On 6/1/X2, an American firm sold inventory

Q40: Which is true of foreign currency forward

Q42: On 6/1/X2, an American firm purchased a

Q45: Blue & Green, Inc. sold merchandise for

Q46: On 6/1/X2, an American firm purchased a

Q47: On November 1, 20X1, DEMO Corp., a

Q48: On January 1, 20X1, a domestic firm

Q56: Which of the following is not true

Q60: In the accounting for forward exchange contracts,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents