On January 1, 20X1, Pepper Company purchased 90% of the common stock of Salt Company for $360,000 when Salt had total shareholders' equity as follows:

Any excess of cost over book value on this date is attributed to a patent, to be amortized over 10 years. The 8% preferred stock is cumulative, non-participating, and has a liquidating value of par plus dividends in arrears. There were no preferred dividends in arrears on January 1, 20X1. Pepper elected to account for its investment in Salt using the cost method.

During 20X1, Salt had a net loss of $10,000 and paid no dividends. In 20X2, Salt had net income of $100,000 and paid dividends totaling $36,000.

During 20X2, Salt sold merchandise to Pepper for $40,000, of which $20,000 is still held by Pepper on December 31, 20X2. Salt's usual gross profit is 40%.

Required:

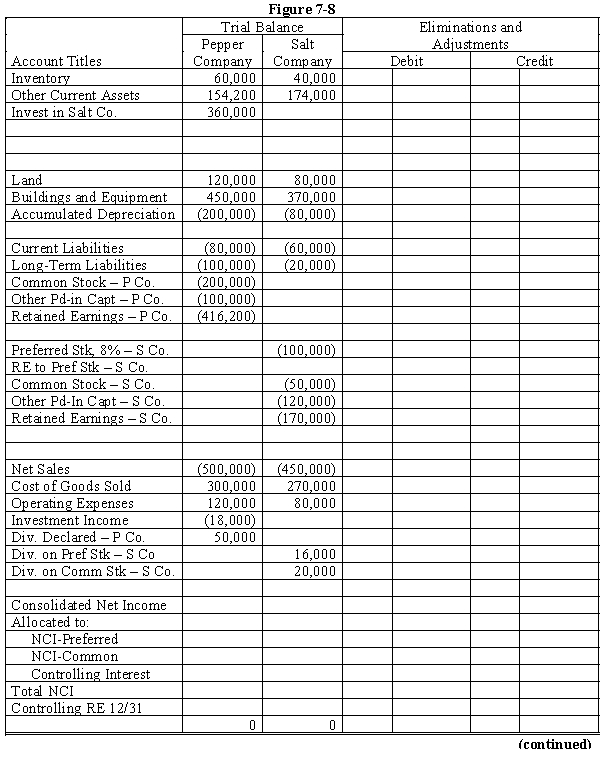

Complete the Figure 7-8 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: When preparing a consolidated balance sheet worksheet

Q29: Saddle Corporation is an 80%-owned subsidiary of

Q32: Pilatte Company acquired a 90% interest in

Q33: On January 1, 20X1, Poplar Company acquired

Q34: Company P owns an 90% interest in

Q34: Pepin Company owns 75% of Savin Corp.Savin's

Q36: On January 1, 20X1, Patrick Company purchased

Q37: Which of the following is not true

Q37: On January 1, 20X1, Patrick Company purchased

Q39: On January 1, 20X1, Company P purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents