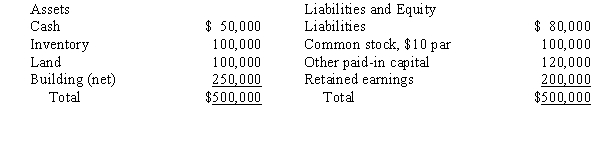

Company P acquired 60% of the outstanding common stock of Company S by issuing common stock with a market value of $420,000 on January 1, 20X3. The balance sheet of Company S was as follows on the acquisition date:  The market values were as follows: Inventory, $130,000; Land, $150,000; Building, $400,000. The inventory was sold during 20X3, the building has a 10-year life, and any excess purchase price is attributed to goodwill. What adjustment is needed to consolidated net income to arrive at cash flow-operations for 20X4, under the indirect method, as a result of amortization of excesses from the purchase?

The market values were as follows: Inventory, $130,000; Land, $150,000; Building, $400,000. The inventory was sold during 20X3, the building has a 10-year life, and any excess purchase price is attributed to goodwill. What adjustment is needed to consolidated net income to arrive at cash flow-operations for 20X4, under the indirect method, as a result of amortization of excesses from the purchase?

A) $1,000

B) $9,000

C) $14,800

D) $15,000

Correct Answer:

Verified

Q1: Program Corporation owns 70% of Solution Company.

Q2: Ponti Company purchased the net assets of

Q6: Company P purchased an 80% interest in

Q10: A parent company owns 80% of the

Q11: The purchase of additional shares from the

Q11: Dividends paid by a subsidiary have the

Q13: Which of the following is not true

Q15: Amortization of excesses in periods subsequent to

Q17: The purchase of additional shares directly from

Q18: When the acquisition of a subsidiary occurs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents