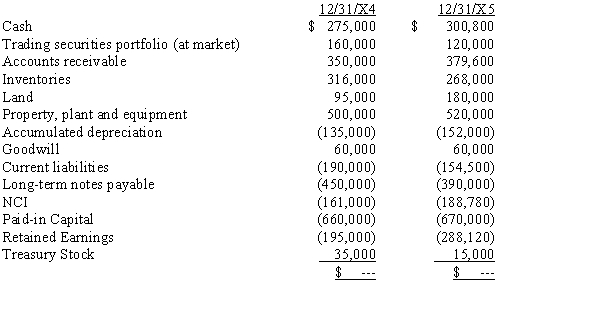

The following comparative consolidated trial balances apply to Perella Company and its subsidiary Sherwood Company (80% control):

The following is additional information for 20X5:

a)No trading securities were sold nor were any investments added to the portfolio.

b)Land was acquired by issuing a $40,000 note and giving cash for the balance.

c)Equipment (cost $50,000; accumulated depreciation $40,000) was sold for $3,000

d)Dividends declared and paid: Perella 50,000; Sherwood $40,000.

e)Consolidated net income amounted to $178,900.

Required:

Prepare the consolidated statement of cash flows for the year ended December 31, 20X5, for Perella and its subsidiary.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: One complication that arises in consolidation when

Q30: Consolidated firms that meet the tax law

Q37: Company P purchased an 80% interest in

Q38: Company P purchased an 80% interest in

Q40: For ownership interest of less than 20%,

Q40: The following comparative consolidated trial balances apply

Q42: On January 1, 20X1, Parent Company acquired

Q43: Plymouth Company holds a 90% interest in

Q44: Dills Company purchased an 80% interest in

Q48: Discuss how the following items affecting shareholder

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents