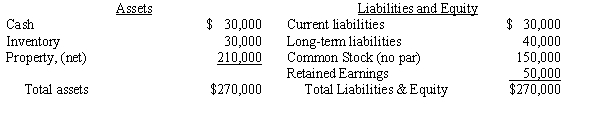

Plaza Company acquires an 80% interest in Scenic Company for $200,000 cash on January 1, 20X1. On that date, Scenic's equipment (remaining economic life of 5 years) is undervalued by $25,000; any excess of cost over book value is attributed to goodwill. Scenic's balance sheet on the date of the purchase is as follows:

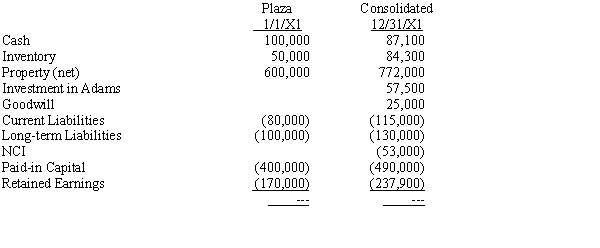

The controlling interest in consolidated net income for 20X1 is $97,900; the noncontrolling interest is $6,000. On December 31, 20X1, Plaza acquired a 15% interest in Adams, Inc. and, in an unrelated transaction, issued additional common stock. Dividends declared and paid during the year by Plaza and Scenic were $30,000 and $15,000, respectively. There are no purchases or sales of property, plant, or equipment during the year. Based on the following information, prepare a statement of cash flows using the indirect method for Plaza Company and its subsidiary for the year ended December 31, 20X1.

Required:

Prepare the consolidated statement of cash flows for the year ended December 31, 20X1, for Plaza and its subsidiary.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Company P acquired 80% of the outstanding

Q21: Plateau Company acquires an 80% interest in

Q22: Company P purchased an 75% interest in

Q24: Plymouth Company holds a 90% interest

Q24: Because good will is amortized over 15

Q26: In calculating the voting power and market

Q27: When an affiliated group elects to be

Q27: Company P purchased an 80% interest in

Q30: Company S has been an 80%-owned subsidiary

Q33: For companies that meet the requirements of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents