On January 1, 20X1 Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill. Parent accounts for the Investment in Subsidiary using the simple equity method.

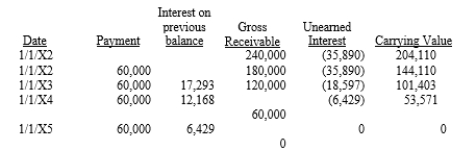

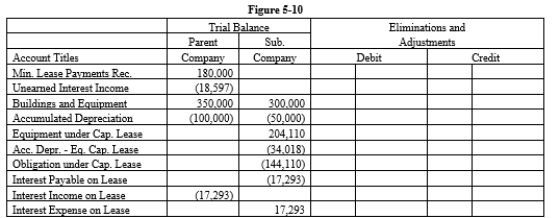

On January 1, 20X2, Parent purchased equipment for $204,110 and immediately leased the equipment to Subsidiary on a 4-year lease. The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments. The implicit interest rate is 12%. The lease provides for an automatic transfer of title at the end of 4 years. The estimated useful life of the equipment is 6 years. The lease has been capitalized by both companies. The lease amortization schedule is presented below:

Required:

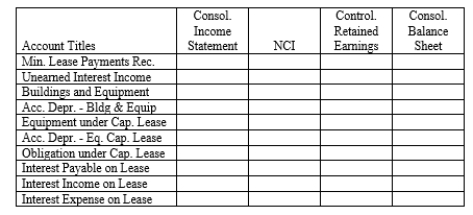

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-10 partial worksheet as of December 31, 20X2. Key and explain all eliminations and adjustments.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: On January 1, 20X4, Parent Company purchased

Q42: On January 1, 20X1, Parent Company acquired

Q43: The Planes Company owns 100% of the

Q44: On January 1, 20X4, Parent Company purchased

Q45: On January 1, 20X4, Parent Company purchased

Q47: Tempo Industries is an 80%-owned subsidiary of

Q48: Smart Corporation is a 90%-owned subsidiary of

Q49: On January 1, 20X1, Parent Company purchased

Q50: On January 1, 20X1, Parent Company purchased

Q51: On January 1, 20X1, Parent Company acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents