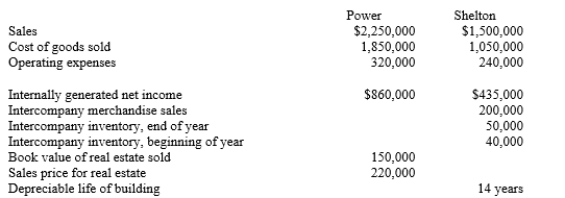

Power Company owns an 70% controlling interest in the Shelton Company. Shelton regularly sells merchandise to Power, which then sells to outside parties. The gross profit on these sales is the same as sales to outside parties. On January 1, 20X4, Power sold land and a building to Shelton. Twenty percent of the price of the real estate was allocated to land and the remaining amount to structures. Additional information for the companies for 20X4 is summarized as follows:

Prepare income distribution schedules for 20X4 for Power and Shelton as they would be prepared to distribute income to the noncontrolling and controlling interests in support of consolidated worksheets.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: On January 1, 20X1 Bullock, Inc. sells

Q19: Schiff Company owns 100% of the outstanding

Q20: Emron Company owns a 100% interest in

Q21: On 1/1/X1 Peck sells a machine with

Q22: On January 1, 20X1, Parent Company acquired

Q24: The following accounts were noted in reviewing

Q25: Phelps Co. uses the sophisticated equity method

Q26: On January 1, 20X1, Powers Company acquired

Q27: Company P owns 100% of the common

Q28: On January 1, 20X1, a parent loaned

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents