On January 1, 20X1, Parent Company acquired 100% of the common stock of Subsidiary Company for $750,000. On this date Subsidiary had total owners' equity of $540,000.

Any excess of cost over book value is attributable to land, undervalued $10,000, and to goodwill.

During 20X1 and 20X2, Parent has appropriately accounted for its investment in Subsidiary using the simple equity method.

On January 1, 20X2, Parent held merchandise acquired from Subsidiary for $10,000. During 20X2, Subsidiary sold merchandise to Parent for $100,000, of which $20,000 is held by Parent on December 31, 20X2. Subsidiary's usual gross profit on affiliated sales is 40%.

On December 31, 20X2, Parent still owes Subsidiary $20,000 for merchandise acquired in December.

On January 1, 20X2, Parent sold to Subsidiary some equipment with a cost of $50,000 and a book value of $20,000. The sales price was $40,000. Subsidiary is depreciating the equipment over a five-year life, assuming no salvage value and using the straight-line method.

Required:

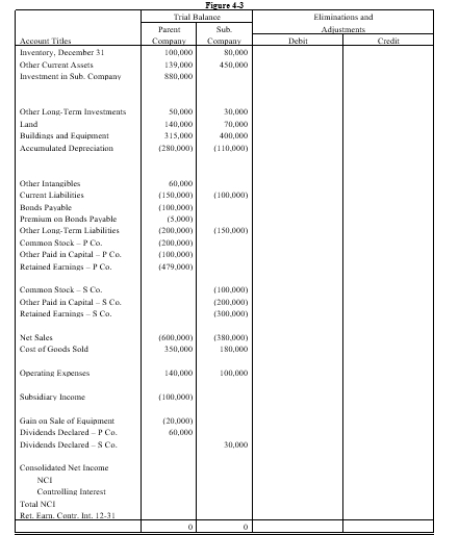

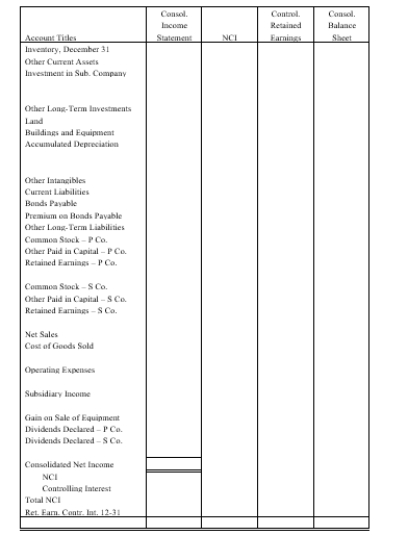

Complete the Figure 4-3 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: On January 1, 20X1, Powers Company acquired

Q27: Company P owns 100% of the common

Q28: On January 1, 20X1, a parent loaned

Q29: During 20X3, a parent company billed its

Q30: Phelps Co. uses the sophisticated equity method

Q32: Patti Corp. has several subsidiaries (Aeta, Beta,

Q33: On January 1, 20X1, Pinto Company purchased

Q35: Selected information from the separate and consolidated

Q36: On January 1, 20X1, Parent Company acquired

Q42: For each of the following intercompany transactions,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents